The forex market is the only financial market that remains open 24 hours a day. This is because of the time zone differences, with the market opening with the Sydney session and closing with the New York session. Forex is also the most liquid financial market in the world. Interestingly, forex trading differs from trading any other instrument because currencies are always traded in pairs.

Ready to make your first foray into this arena? Here are the most important things beginners should know before they trade forex.

Did you know?

You can trade more than 60 forex pairs with ADSS. We offer leverage up to 500:1 on some pairs, plus spreads as low as 0.7 pips on selected pairs.

1. What Constitutes a Currency Pair?

A currency pair consists of a base currency and a quote currency. The price is quoted in terms of the quote currency and tells you how much of the base currency you will need to buy one unit of the quote currency.

For example, if you were trading the EUR/USD (euro/US dollar) pair. The EUR is the base currency, and the USD is the quote currency. So, if the price quoted is 1.1140, it means that you will be able to buy $1 with €1.1140.

2. Types of Currency Pairs

Currency pairs are classified as major, minor or exotic, based on their global trade volumes and the types of currencies included in the pairs.

Did you know?

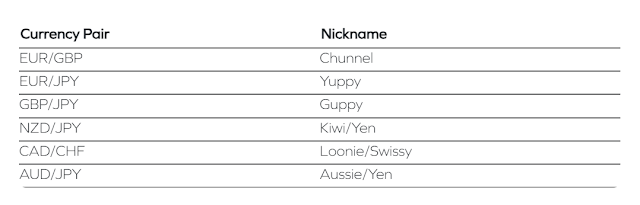

Many currencies and even currency pairs have their own nickname. For example, the Canadian dollar is also called the Loonie because the reverse of the C$1 coin has a picture of a loon (a type of bird).

Major Pairs

These are pairs that see the highest trade volume. They usually include USD as one of the currencies in the pair.

Did you know?USD is the most traded currency, accounting for 80% of forex trade volumes. And 24% of global forex trade involves EUR/USD.

Minor Pairs

These currency pairs see lower trading volumes than majors. Most do not include USD but do include currencies associated with developed economies.

Exotic Pairs

These currency pairs see the lowest trade volumes, accounting for about 10% of all forex trading. These usually include a currency of an emerging economy. Some examples of exotic pairs are USD/CNH, USD/MXN, and EUR/TRY.

3. Bid Price and Ask Price

This is the first trading term that you should be familiar with. The bid price is the price a buyer will pay to buy a currency, while the ask price is the price a seller will sell a currency at. Generally, the ask price tends to be higher than the bid price.

4. Spreads and Pips

The difference between the ask and bid prices is known as the spread. This is the cost of trading forex. The narrower the spread, the cheaper the trade.

For example, let’s take the GBP/USD pair. Suppose the ask price is 1.3554 and the bid price is 1.3556. The difference between the two prices is 1.3556 – 1.3554 = 0.0002. So, the spread that you pay to trade this pair is $0.0002 per unit of currency bought or sold.

A pip or point in percentage measures the change in value of the currency pair. It is the smallest possible movement in value and is usually calculated up to the 4th decimal place. The only exception is the Japanese yen, for which the price is calculated to the second decimal place.

5. Factors Affecting Currency Prices

Economic and geopolitical events impact interest in a specific currency and, therefore, its value. Some of the factors that have the most impact on forex rates are:

Central bank monetary policy changes:

When a central bank of a nation increases interest rates, it attracts buyers to the domestic currency, driving up its value.

Inflation rate:

Inflation has a direct impact on the domestic currency’s value. Rising inflation tends to weaken the currency.

Economic health of the nation:

When the GDP and employment rates improve, it indicates a growing economy. This often has a positive impact on the currency.

Government debt:

For a country, borrowing more than it is lending signals a weakening economy, which tends to weaken its domestic currency.

Did you know?

The US NonFarm Payroll (NFP) report, released on the first Friday of every month, is one of the biggest market movers in forex.

6. Analysing the Market

Informed trading decisions depend on two major types of analyses:

Fundamental Analysis

This is the study of intrinsic factors, economic data, latest news and events of the nation the currency belongs to. Major economic announcements, national events, economic crises, and general market sentiment impact forex rates.

Technical Analysis

This is the study of historical price movements to predict future price direction. It uses charts to provide a visual and easy-to-understand depiction of price trends and patterns. The three most commonly used types of charts are line charts, candlestick charts and bar charts. Different types of technical indicators are used to deduce market trends and predict price movements from these charts. Some of the popular ones include Bollinger Bands, Moving Averages, Relative Strength Index and Stochastic Oscillator.

Read more about these types of analysis here.

Key Takeaways

Forex trading requires an understanding of the forex market and its most commonly used terms.

Major currency pairs offer the highest liquidity since they see the highest trading volumes.

The cost of trading includes not just the commission that may be charged by the broker but also the spread.

Forex trading also requires familiarity with technical and fundamental analysis. This is conveniently done from online trading platforms like MT4 and MT5.

Open a live account with ADSS and gain access to more than 60 currency pairs on the most popular trading platform, MT4.